📢 Take Control of Your Auto Loan with Our Car Loan Payoff Calculator! 🚗💨

Want to pay off your car loan faster and save on interest? Our Car Loan Payoff Calculator helps you determine how much extra you need to pay each month to clear your debt sooner. Simply enter your loan details, adjust your payment strategy, and see how much you can save over time. Whether you’re looking to refinance or make early payments, this tool provides instant, accurate results to guide your financial decisions.

💰 Start planning your debt-free journey today!

Car Loan Payoff Calculator

Paying off a car loan faster can save you thousands in interest and free up your finances. A Car Loan Payoff Calculator helps you determine how quickly you can clear your auto loan by making extra payments or adjusting your payment schedule. This guide explains how the calculator works, key factors to consider, and expert tips to pay off your car loan faster.

📊 How Does a Car Loan Payoff Calculator Work?

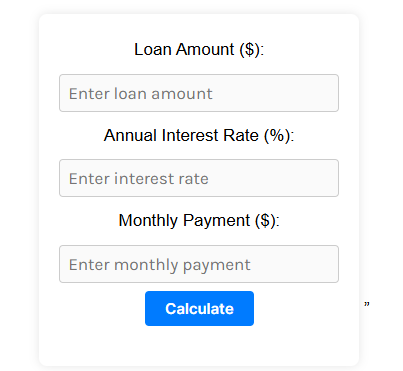

A Car Loan Payoff Calculator estimates how much time and interest you can save by making additional payments. It takes into account:

✔ Loan Amount: The total amount borrowed. ✔ Interest Rate (APR): The percentage charged on the loan balance. ✔ Loan Term: The number of months or years you plan to pay the loan. ✔ Monthly Payment: Your regular installment amount. ✔ Extra Payments: Additional payments made towards the principal.

The calculator then provides: 📌 New Loan Payoff Date – Adjusted based on extra payments. 📌 Total Interest Savings – The amount saved over the life of the loan. 📌 Updated Monthly Payments – If refinancing or increasing payment amounts.

🛠️ Example Calculation

📌 Car Loan Details:

- Loan Amount: $25,000

- Interest Rate: 5% APR

- Loan Term: 5 Years (60 Months)

- Monthly Payment: $471

- Extra Monthly Payment: $100

👉 New Payoff Time: 4 Years, 2 Months

👉 Total Interest Savings: $1,300+

By adding just $100 extra per month, you could pay off your loan almost 10 months earlier and save over $1,300 in interest!

💡 Strategies to Pay Off Your Car Loan Faster

🚀 1. Make Biweekly Payments

Instead of paying once a month, split your payment into two and pay every two weeks. This results in one extra payment per year, reducing your loan term.

💰 2. Round Up Your Payments

If your monthly payment is $471, round it up to $500. That extra $29 each month can shave off months from your loan.

📈 3. Make Lump-Sum Payments

Apply tax refunds, bonuses, or unexpected income directly to your loan principal to cut down interest and time.

🔄 4. Refinance for a Lower Rate

If interest rates have dropped or your credit score has improved, refinancing can lower your monthly payments and total interest costs.

📊 5. Avoid Skipping Payments

Even if your lender allows deferrals, skipping payments adds interest, increasing the total cost of your loan.

🚗 Benefits of Using a Car Loan Payoff Calculator

✔ Visualizes Impact of Extra Payments – Helps you see how additional payments affect your loan term. ✔ Saves Money on Interest – Reduces the total cost of the loan. ✔ Speeds Up Loan Repayment – Shortens loan duration. ✔ Improves Financial Planning – Helps you budget better for early payoff goals.

❓ FAQs

Q1: Can I pay off my car loan early?

Yes! Most lenders allow early payments, but check for prepayment penalties.

Q2: How much extra should I pay each month?

Use a Car Loan Payoff Calculator to see how different amounts affect your loan.

Q3: Does paying off a car loan early improve my credit score?

It may, as it lowers your debt-to-income ratio, but keeping older accounts open helps build credit history.

Q4: Can I refinance my loan to get a better deal?

Yes, refinancing can reduce interest rates and lower monthly payments.

Q5: What’s the fastest way to pay off my car loan?

Biweekly payments, extra principal payments, and lump-sum payments are effective methods.

📢 Conclusion

A Car Loan Payoff Calculator is a powerful tool to help you take control of your finances and pay off your car loan faster. Whether you’re looking to make small extra payments or a large lump sum, knowing the impact on your loan can help you save money and reach financial freedom sooner.

💡 Ready to pay off your car loan faster? Use a Car Loan Payoff Calculator today and take charge of your financial future! 🚗💰