An EMI (Equated Monthly Installment) Calculator is a handy tool that helps you determine the monthly payments you’ll need to make on a loan. If you’re looking for a DeepSeek EMI Calculator, it likely refers to a tool or feature provided by DeepSeek to calculate EMIs for loans, such as personal loans, home loans, or car loans.

Deepseek EMI Calculator

Managing loans can be overwhelming, especially when you’re unsure about how much you’ll need to pay each month. That’s where the DeepSeek EMI Calculator comes in—a powerful tool designed to simplify loan planning and help you make informed financial decisions. Whether you’re applying for a home loan, car loan, or personal loan, the DeepSeek EMI Calculator ensures you know exactly what to expect. In this blog, we’ll explore how this tool works, its benefits, and why it’s a must-have for anyone considering a loan.

Try now: Deepseek Mortgage Calculator

What is an EMI Calculator?

An EMI (Equated Monthly Installment) calculator is a financial tool that helps you determine the monthly payments you’ll need to make toward a loan. It takes into account three key factors:

- Loan Amount: The total amount you’re borrowing.

- Interest Rate: The rate at which interest is charged on the loan.

- Loan Tenure: The duration over which the loan will be repaid (in months or years).

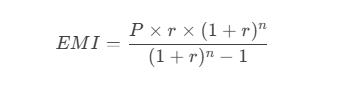

The formula used to calculate EMI is:

Where:

- P = Loan amount (Principal)

- r= Monthly interest rate (annual interest rate divided by 12)

- n= Loan tenure in months

Why Use the DeepSeek EMI Calculator?

The DeepSeek EMI Calculator is a user-friendly tool that offers several advantages:

1. Accuracy

The calculator provides precise EMI amounts, ensuring you have a clear understanding of your monthly obligations.

2. Ease of Use

With its intuitive interface, the DeepSeek EMI Calculator is easy to use, even for those with no financial background.

3. Time-Saving

Instead of manually calculating EMIs, you can get instant results with just a few clicks.

4. Financial Planning

By knowing your EMI in advance, you can plan your monthly budget effectively and avoid financial stress.

How to Use the DeepSeek EMI Calculator

Using the DeepSeek EMI Calculator is simple. Here’s a step-by-step guide:

- Enter the Loan Amount: Input the total amount you wish to borrow.

- Input the Interest Rate: Enter the annual interest rate offered by the lender.

- Select the Loan Tenure: Choose the repayment period in months or years.

- Calculate EMI: Click the “Calculate” button to get your monthly installment amount.

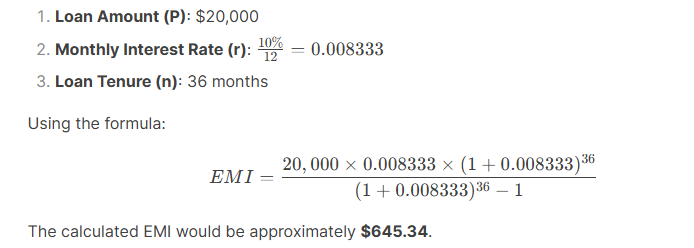

Example Calculation

Let’s say you want to take a loan of $20,000 at an annual interest rate of 10% for a tenure of 3 years (36 months).

Benefits of the DeepSeek EMI Calculator

1. Transparency

The calculator provides a clear breakdown of the principal and interest components of your EMI, helping you understand how much you’re paying toward each.

2. Comparison Tool

You can use the DeepSeek EMI Calculator to compare different loan offers by adjusting the loan amount, interest rate, and tenure.

3. Budgeting

Knowing your EMI in advance allows you to plan your monthly expenses and avoid financial strain.

4. Accessibility

The DeepSeek EMI Calculator is available online, making it accessible anytime, anywhere.

Who Can Benefit from the DeepSeek EMI Calculator?

- Homebuyers: Calculate EMIs for home loans and plan your housing budget.

- Car Buyers: Determine monthly payments for car loans.

- Students: Plan education loan repayments.

- Entrepreneurs: Assess loan options for business financing.

Final Thoughts

The DeepSeek EMI Calculator is more than just a tool—it’s your partner in financial planning. By providing accurate and instant EMI calculations, you can make informed decisions and take control of your finances. Whether you’re applying for a loan or simply exploring your options, the DeepSeek EMI Calculator is a must-have resource.

Pro Tip: Bookmark the DeepSeek EMI Calculator for quick access whenever you need to calculate loan payments. It’s a small step that can make a big difference in your financial journey.